What Type of Tax Benefits available for Startups in India?

Eligible Startups can apply to avail 2 benefits under income Tax

- U/s 80IAC :- Exempt tax on 100% Profit and gain from business for 3 consecutive financial year.

- U/s 56(2)(viib) ( Angel Tax):- Exempt tax on investment in share capital; excess share premium value over fair market value.

Who can Apply for Tax Benefit?

- a Startup recognized by DPIIT ( previously known as DIPP)

- only a Private Limited Company or Limited Liability Partnership (LLP)

- incorporated on or after 1st day of April 2016.

My Entity Recognised as Startup by DPIIT. Is this sufficient to avail tax exemption?

- No. To avail tax exemption, you need to apply separately through DPIIT.

What are chances to get Tax Exemption certificate?

- Based on the information, documents and making enquiries by department, as it may dim fit,

EITHER, approve your application and issue certificate

OR, Reject with reason.

How to Apply for Tax Exemption Certificate U/s 80-IAC of Income Tax Act

As per Revised Rule vide Notification dated 11th April '2018 issued by Ministry of Commerce and Industry ( Department for Promotion of Industries and Internal Trade) -

A Startup being a Private Limited Company or Limited Liability Partnership (LLP) incorporated after 1st April 2016 may, for obtaining a certificate for the purpose of section 80-IAC of the Income Tax Act, make an application in Form-I along with documents specified therein to the Board and the Board may after calling for such documents or information and making such enquires, as it may deem fit -

Either

i) Issue Tax Exemption Certificate.

or

ii) Reject the application by providing reasons.

When to apply?

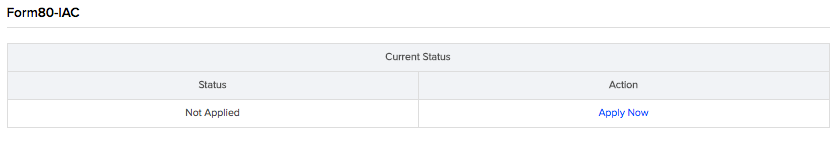

Post getting recognition a Startup may apply for Tax exemption under section 80 IAC of the Income Tax Act. Post getting clearance for Tax exemption, the Startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation.

How to Apply?

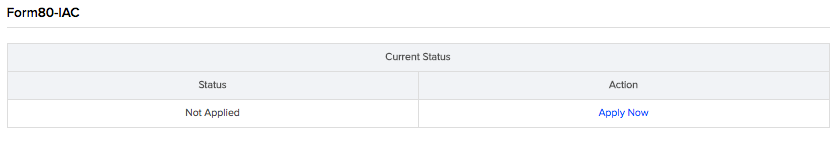

Login at Startup India Portal, then go to your dashboard and access 'Recognition and Tax Exemption'. Once you lick and enter on this page, there is an option to Apply

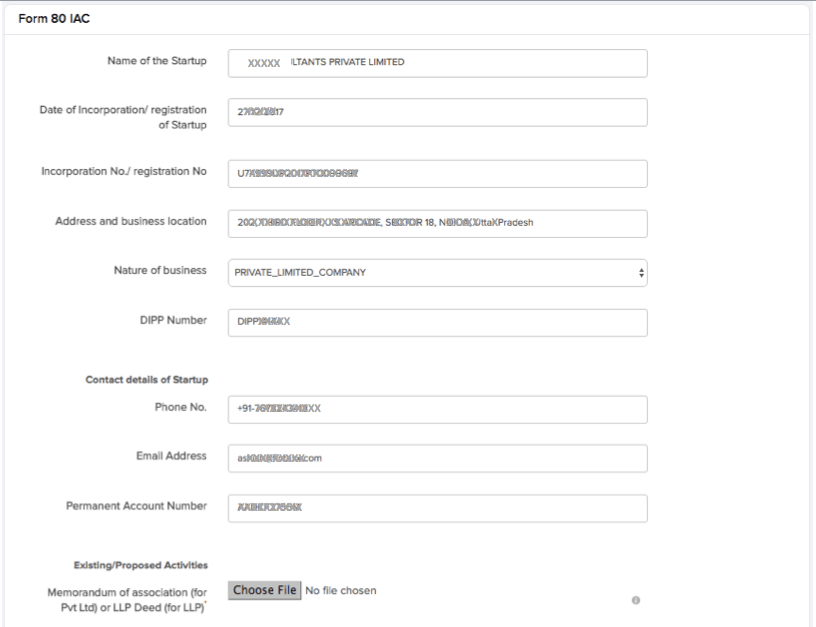

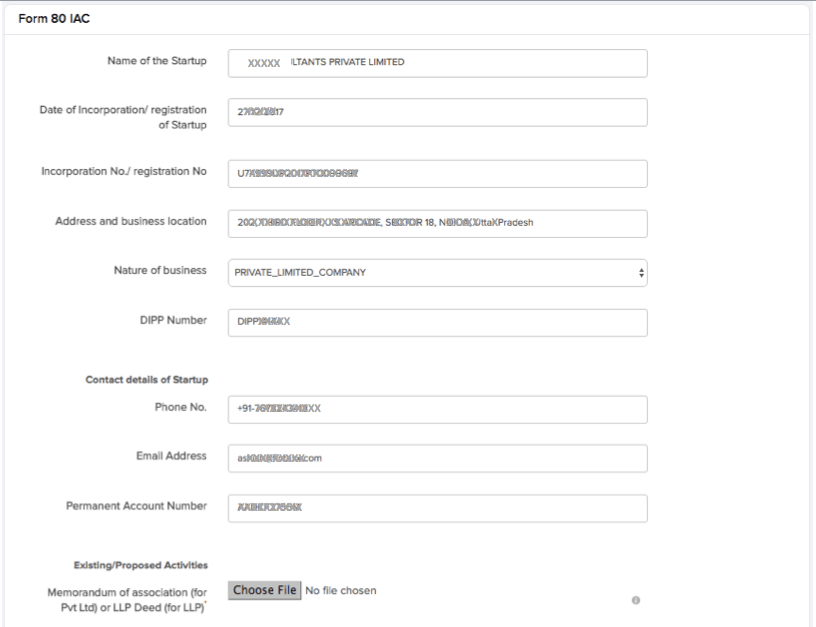

Click on Apply Now. Next Step is to fillup Form I along with neccessary documents and information as prescribed.

Click on Apply Now. Next Step is to fillup Form I along with neccessary documents and information as prescribed.

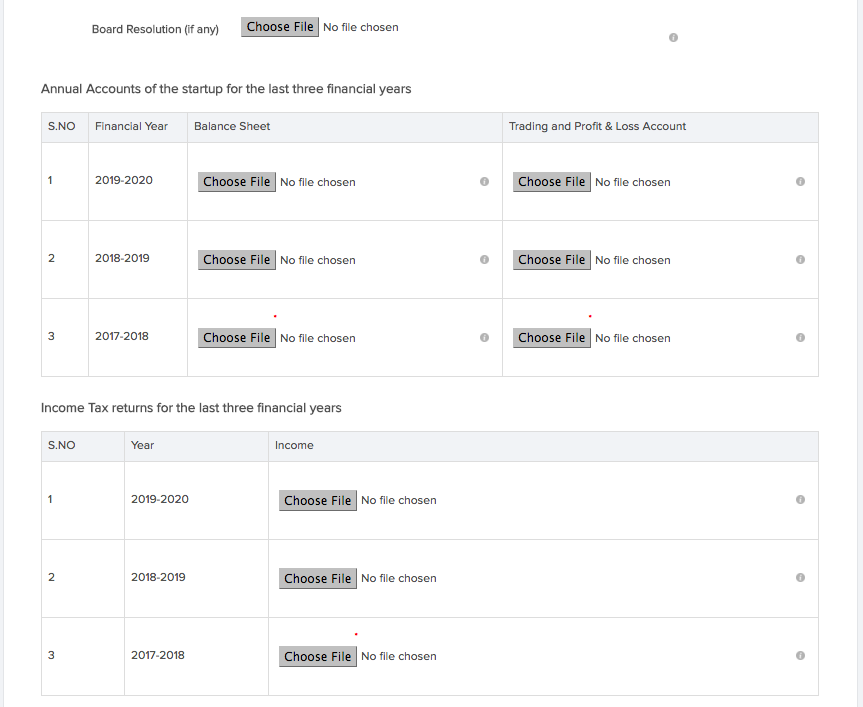

What are the various documents to attach online?

- Memorandum of Association for Private Company or Partnership Deed for LLP

- Board Resolution ( Optional)

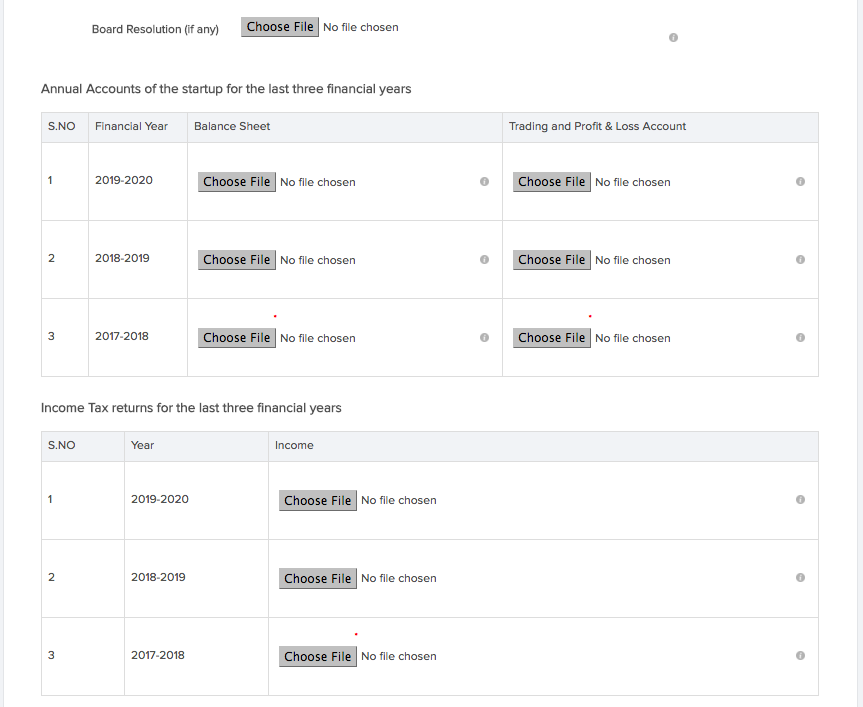

- Last 3 years Audited Balance Sheet and Profit and Loss Statement. If 3 Years not available, then atleast attachment latest year's copy.

- Last 3 Years Income Tax Return. If 3 Years not available, then atleast attachment latest year's copy.

Department may also ask for further documents and information for their satisfaction to grant exemption.

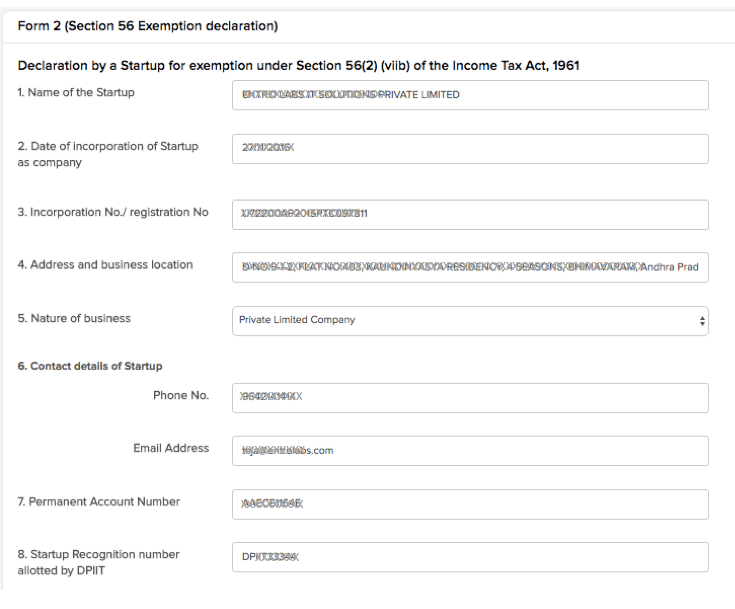

How to Apply for Tax Exemption Certificate U/s 56 (2) (viib) of Income Tax Act (Angel Tax) - Tax on Investment in Share Capital

What is angel tax?

Angel tax is a term used to refer to the income tax payable on capital raised by unlisted companies via issue of shares where the share price is seen in excess of the fair market value of the shares sold. The excess realisation is treated as income and taxed accordingly. The tax was introduced in the 2012 Union Budget by then finance minister Pranab Mukherjee to arrest laundering of funds. It has come to be called angel tax since it largely impacts angel investments in startups

As per Revised Rule vide Notification dated 11th April '2018 issued by Ministry of Commerce and Industry ( Department of Industrial Planning and Promotion) and subsequently modified on 19th February 2019 by the ministry-

ELIGIBILITY CRITERIA:-

A Startup being a Private Limited Company or LLP recognised as Startup shall be eligible to apply for approval for the purpose of Section 56(2)(viib) of the Income Tax Act ( popularly known as ANGEL TAX), if the following conditions are fulfilled:-

(i) the agreegate amount of paidup share capital and share premium of the startup after the proposed issue of share capital does not exceed Rs 25 crores.

(ii) the investor/proposed investor, who proposed to subscribe to the issue of share of the startup has

a) the average returned income of the Rs 25 Lakhs or more for the proceeding three financial years, or

b) the networth of Rs 2 Crores or more as on the last date of the proceeding financial year, and

(iii) the startup has obtained a report from a merchant banker specifying the fair market value of share in accordance with rule 11UA of the Income Tax Rule, 1962.

(iv) Benefit available for 10 years.

APPLICATION & APPROVAL PROCESS:-

The application for approval under this para shall be made in Form-2 to the Board and shall be accompanied by documents specified therein.

And Board may after calling for such documents or information and making such enquires, as it may deem fit -

Either

i) Grand approval for the purpose of Section 56(2)(viib) of the Act, specifying the relevent details, including details of investors, amounts of premium on which shares are to be issued and the latest date by which the shares are to be issued;

or

ii) Decline to grant the said approval after providing reasons.

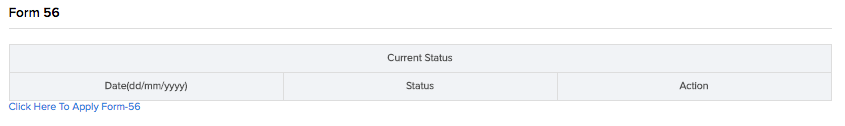

How to Apply?

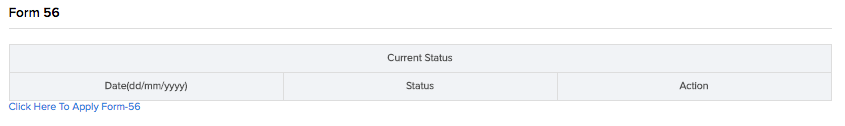

Login at Startup India Portal, then go to your dashboard and access 'Recognition and Tax Exemption'. Once you lick and enter on this page, there is an option to Apply

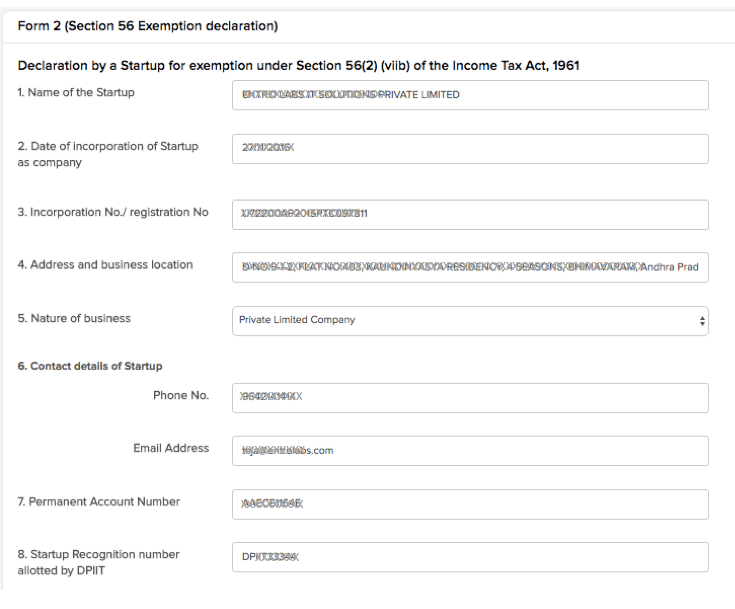

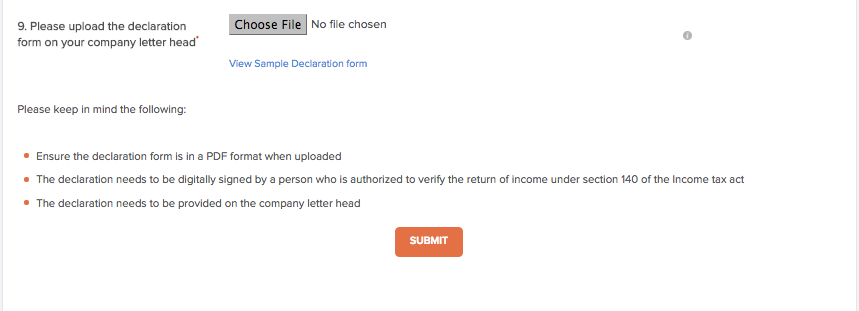

Next Step is to fillup Form 2 along with neccessary documents and information as prescribed.

Next Step is to fillup Form 2 along with neccessary documents and information as prescribed.

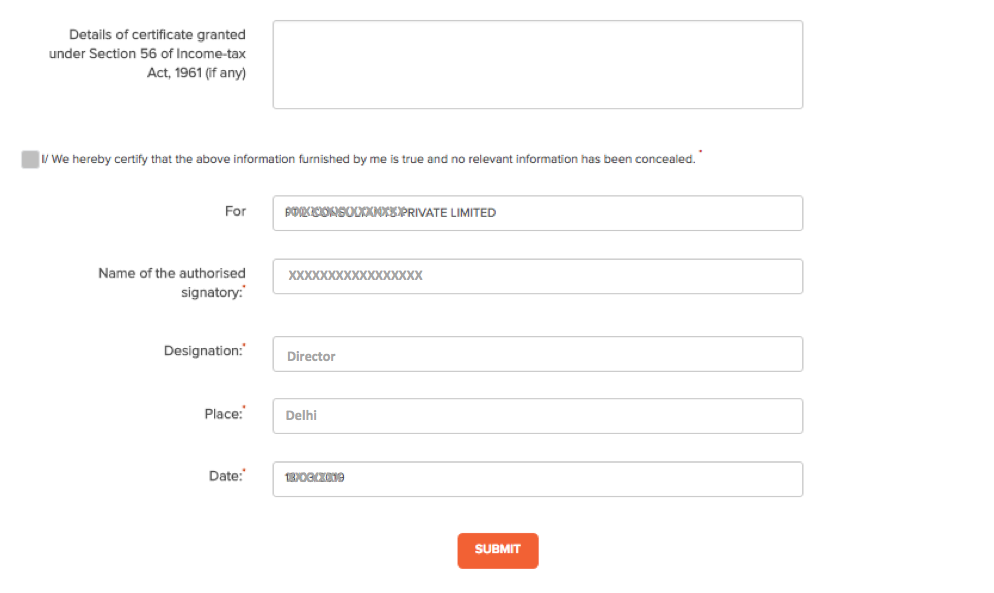

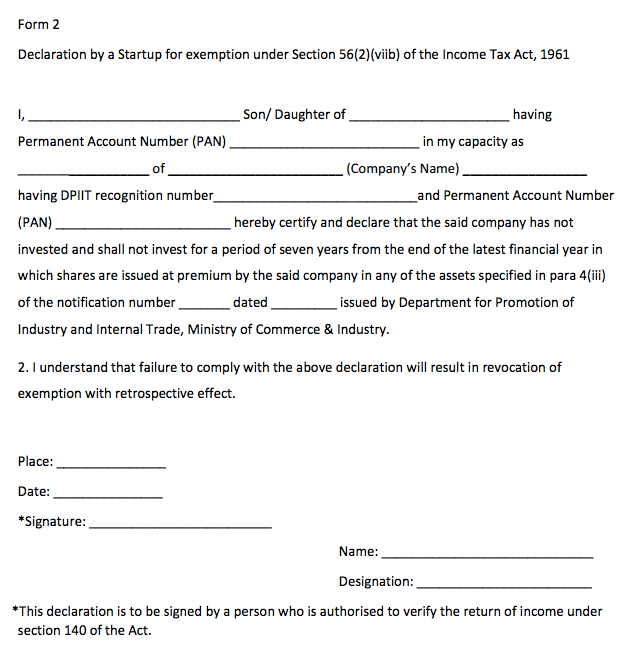

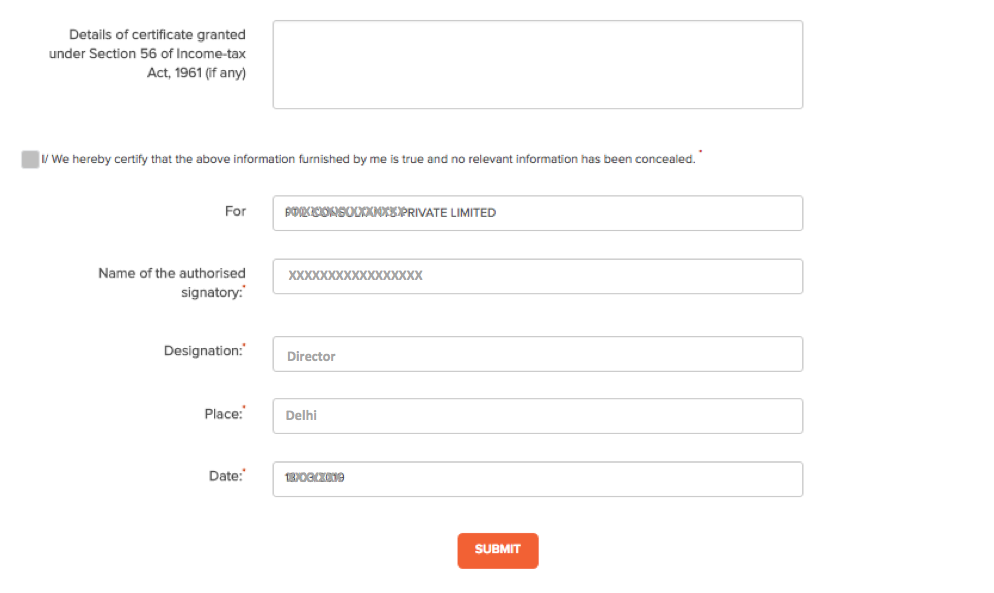

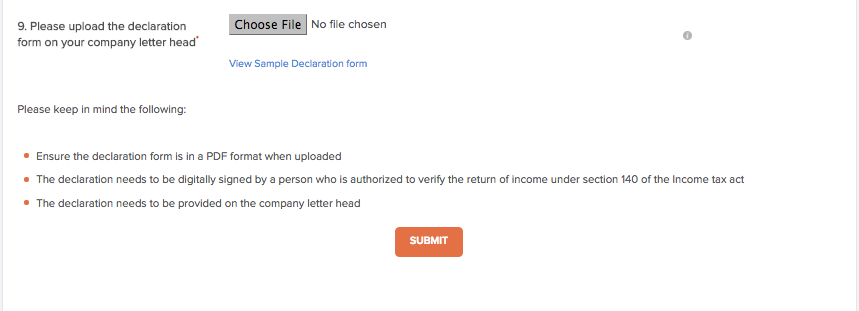

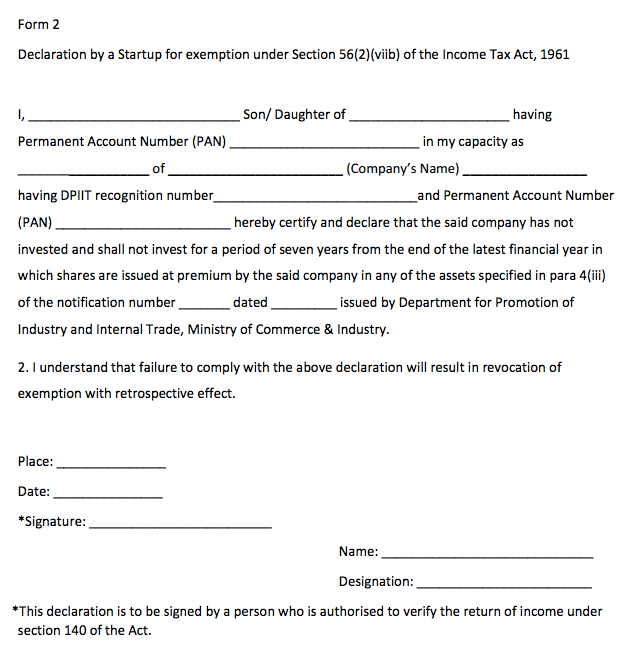

SAMPLE DECLARATION FORM

SAMPLE DECLARATION FORM

To be exempted from angel tax, start-ups will have to submit self-certified declaration along with audited financials and income tax returns of the previous year.

The documents will be validated by the DPIIT and then the CBDT will set up a mechanism through which such recognised start-ups do not get notices for angel tax.

The government however stated few conditions under which the start-ups will be eligible for the exemption under Section 56 (2) (viib) of the Income Tax Act. It clarified that the start-up will be eligible if it is a private limited company recognised by DPIIT, and is not investing in any of the following assets:

- building or land appurtenant thereto, being a residential house, other than that used by the Start-ups for the purposes of renting or held by it as stock-in-trade, in the ordinary course of business;

- land or building, or both, not being a residential house, other than that occupied by the Start-ups for its business or used by it for purposes of renting or held by it as stock-in trade, in the ordinary course of business;

- loans and advances, other than loans or advances extended in the ordinary course of business by the Start-ups where the lending of money is substantial part of its business;

- capital contribution made to any other entity;

- shares and securities;

- a motor vehicle, aircraft, yacht or any other mode of transport, the actual cost of which exceeds ten lakh rupees, other than that held by the Start-ups for the purpose of plying, hiring, leasing or as stock-in-trade, in the ordinary course of business;

- jewellary other than that held by the Start-ups as stock-in-trade in the ordinary course of business;

- any other asset, whether in the nature of capital asset or otherwise, of the nature specified in sub-clauses (iv) to (ix) of clause (d) of Explanation to clause (vii) of sub-section (2) of section 56 of the Act.

***

For more knowledge connect with our Consultant at FinTax Corporate Professionals LLP | +91-7678243418 / +91-120-4203375

Send your Requirement here

THANK YOU!

You will receive a call shortly

Click on

Click on