FinTax Corporate Professionals LLP – India's top Startup Consultant. We advise and support Startups, SMEs, Aspiring Entrepreneurs in Startup counselling, Startup Business Registration, Startup Recognition, Accounting, Taxation and Legal Compliances. # Email Us: info@fintaxx.in #+91-7210000745

Startup Consultants in India, Top Startup Consultants, Top StartupIndia Consultants, Top Startup India Consultants, DIPP Consultants, DPIIT Registration Consultants, How to Apply for Startup India, StartupIndia Recognition Online, Startup Registration Procedure

========

We are India's leading Startup and SME Consultants delivering various professional services across India viz. Startup Company Registrations, Startup Recogntion, ROC Compliances, Audit and other various registrations services.

What is Startup? Eligibility for Startup Recognition

Startup means an entity, incorporated and registered in india

- As a Private Limited Company or Limited Liability Partnership or Registered as a Partnership Firm.

- With an annual turnover not exceeding Rs. 100 crore for any of the financial years since incorporation/registration.

- Working towards innovation, development or improvement or of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

- An entity formed by splitting up or reconstruction of an existing business shall not be considered a ‘Startup’.

- Shall not be more than 10 years old for Startup recognition OR not incorporated before April 2016 to claim Tax Exemption certificate.

- Shall not be a holding or Subsidiary company.

An entity shall cease to be a Startup,

- On completion of 10 years from the date of incorporation/registration.

- If its turnover for any previous year exceeds Rs. 100 crore

Who are not Eligible ?

1. Proprietorship Firm, 2) Unregistered Partnership Firm, 3) Limited Company, 3) Any Non Profit organisation viz. NGO, Association etc. 4) Any other Organisation whose nature of formation not covered under eligibility as cited above.

BASIC REQUIREMENTS FOR APPLICATION FILING

1) Certificate of Incorporation / Registration Certificate and PAN Card of the Entity

2) One Communication Email ID and Mobile No.

3) No. of Directors/partners ( as on today) with their Full Name, Mobile No. Email ID, Full Address.

4) A Brief Description about your business and Products/Services.

5) Is your business is unique from others?

6) Website, Mobile App or Pitch Deck or Patent or any Professional Videography.

7) Total No. of Employees including Directors/partners?

Our Consultation Fee Rs. 15,000/- + 18% GST

RECOGNITION IN 2-3 Working days

MORE DETAILS CLICK HERE:- https://www.fintaxx.in/service/registration/startup-india-dipp-certificate

![Startup Consultants in]()

Startup India Recognition Benefits

Tender Participation

Central Govt. and PSUs gives relaxation to Startups for Participating in public procurement, This moves ensures that there are equal opportunities for both startups and experienced entrepreneurs. Earlier this was not possible because all applicants required either ‘prior experience’ or a ‘prior turnover’. But now, public procurement norms have been relaxed for startups and also exempted from EMD money deposit.

Tax Exemption

Once your company get Startup recognition, you can further apply for Income Tax Exemption benefits available u/s 80IAC and U/s 56 relief for Angel Tax relief (Tax on Share Premium).

Govt. Funding Opportunity

Government allotted Rs 10,000 crores funds for investment into startups through Alternate Investment Funds. SIDBI is managing this fund. Startups can apply under this quota.

Participate in various Govt. Scheme

Government issues day to day various schemes for startup to participate. For example, sustainable finance scheme, bank credit facilitation, raw material assistance, etc.

Participate Startup Grand Challenges

Many reputed companies encourage startup entrepreneurs for their solutions. Here gives an opportunity for startup to participate in the scheme and win funding. Recently, Whatsapp, Mahindra, Aditya Birla, many more companies organising such financial assistance scheme with Startup India.

IPR Govt. Fee Concession

In IPR Registration 50%-80% Govt. fee concession available. Example in Trademark, Patent application.

Self Certifications

Eligible for Self-certification and compliance under 9 environmental & labour laws.

Easy Winding up

Windup company in 90 days under insolvency & Bankruptcy code 2016.

Connect Networks

Search and find various startups and connect with them. Get Mentorship, connect with investors and industries.

GEM Portal Seller Registration and Bid

Startup India (DIPP) require for registration at GEM Portal of govt. https://gem.gov.in/

![Startup Business Consultants in]()

FREQUENTLY ASLED QUESTIONS

WHETHER Contractor of Civil construction and Engineering works, Manpower Supply, Facility Management, etc. is eligible to Apply for Startup?

- YES provided it is a Private Limited Company, LLP, OPC or Registered Partnership Firm and Fullfil other aforesaid requirements.

VALIDITY OF THE RECOGNITION CERTIFICATE?

- 10 years from the date of incorporation/Registration of the entity till turnover does not exceeds Rs 100 crores.

RECOGNITION AUTHORITY?

DPIIT ( Department for Promotion of Industry and Internal Trade) ( earlier DIPP) under Ministry of Commerce and Industry is the approval authority of Startup recognition.

Is Tax Exemption is attached by default with all Startup Recognition?

No. As per recent notification dt 11.04.2018, to claim Tax benefit/Exemption under income tax act, you need to apply separately after getting your startup recognised.

Is Foreign company registered in India eligible for Startup India Registration?

Yes. Provided the Company incorporated in India and fulfil all Specified criteria to become eligible for registration.

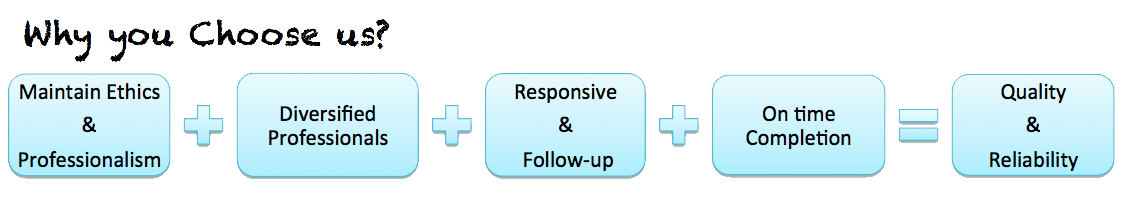

Why you choose our Service?

When you are working towards development or improvement of a product, process or service and/or have scalable business model with high potential for wealth creation and employment, but not able to draw out the business model and write up properly as per DPIIT requirement. Our Experts understand your business and products and helps in write up and application filing.

Therefore, success rate become higher.

#

FinTax Startup and SME Consultant | Call us @ +91-7210000745

#FinTax Corporate Professionals LLP | Startup Consultant